EBA publishes additional supervisory measures on legislative and non-legislative moratoria on loan repayments in light of COVID-19 | Structured Finance In Brief

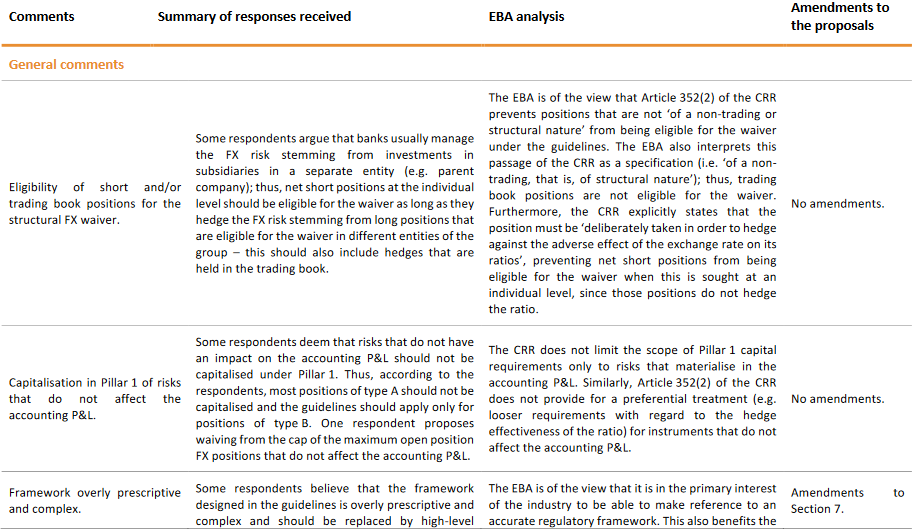

4.2.1 Summary of key issues and the EBA's response | Draft Guidelines on the treatment of structural FX under Article 352(2) of Regulation (EU) No 575/2013 (CRR) (EBA/GL/2020/09) | Better Regulation

Comments on EBA Draft Regulatory Tech- nical Standards on the methods of pruden- tial consolidation under Article 18 of the Regu

19 June 2015 On behalf of the Public Affairs Executive (PAE) of the EUROPEAN PRIVATE EQUITY AND VENTURE CAPITAL INDUSTRY Respons

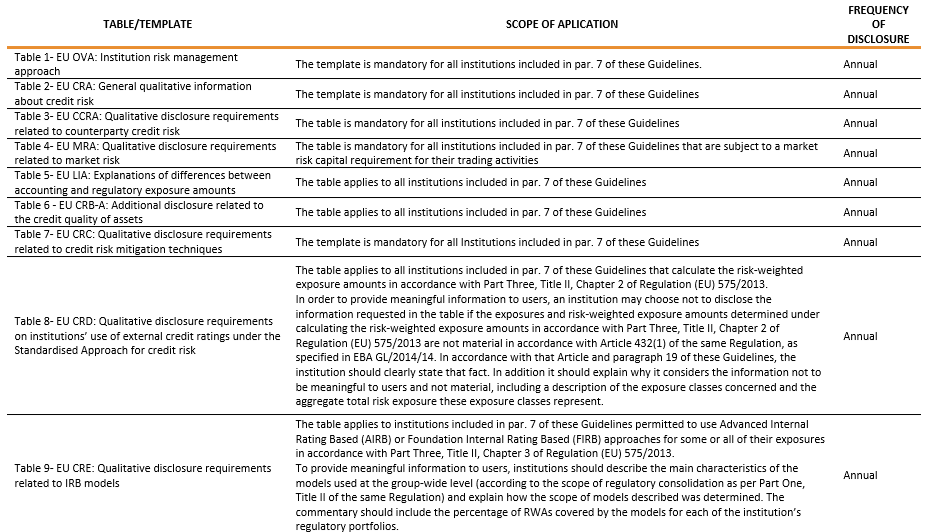

Annex 1 - Overview of the guidelines | Final Report on the Guidelines on disclosure requirements under Part Eight of Regulation (EU) No 575/2013 (EBA/GL/2016/11) (updated 7 June 2017) | Better Regulation

THIS TEXT IS UNOFFICIAL TRANSLATION AND MAY NOT BE USED AS A BASIS FOR SOLVING ANY DISPUTE • Official Gazette of the Republic

Response of the Global Legal Entity Identifier Foundation (GLEIF) to the European Banking Authority Consultation Paper on Draft

Italy EU Regulation 2013 575 The New Definition of Default in Force Since January 1st 2021 - van Berings

Guidelines on sound remuneration policies under Articles 74(3) and 75(2) of Directive 2013/36/EU and disclosures under Article 4

A Magyar Nemzeti Bank 28/2018 (XII.10.) számú ajánlása az 575/2013/EU rendelet 4. cikke (1) bekezdésének 39. pontja szerin

European Banking Authority (EBA) Consultation Paper On Draft Regulatory Technical Standards on prudent valuation under Article 1

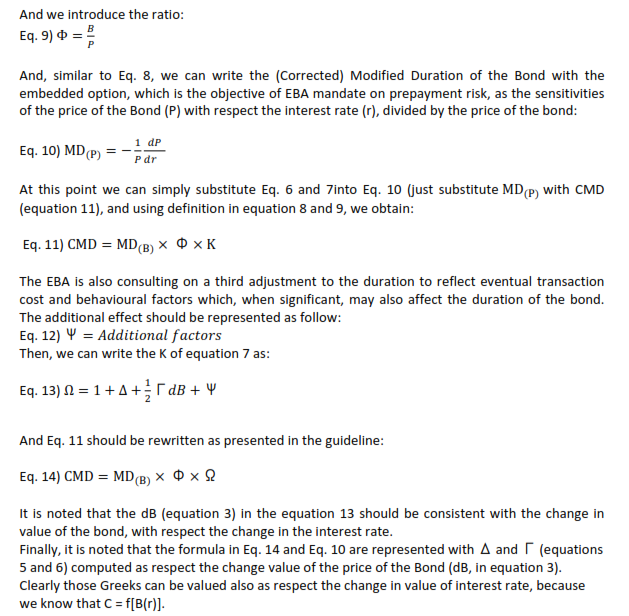

Guidelines on corrections to modified duration for debt instruments under the second subparagraph of Article 340(3) of Regulatio

1 9 May 2014 European Banking Authority Tower 42 25 Old Broad Street London, EC2N 1HQ Submitted via EBA website Re: Draft regula

Attuazione degli Orientamenti dell'EBA sul trattamento delle posizioni in cambi di natura strutturale ai sensi dell'articolo 352, paragrafo 2, del regolamento (UE) n. 575/2013 (CRR) (EBA/GL/2020/09) - EBI - Easy Banca d'Italia

EBA consultation on RTS for identifying credit institutions' large exposures to "shadow banks” | EY Luxembourg

January 16, 2020 Submitted electronically Jose Manuel Campa, Chairperson European Banking Authority Defense 4 – EUROPLAZA 20 A